Do you know about the Carbon Tax Act that was implemented in 2019? Are you aware that your plant may be liable to pay for greenhouse gases it releases throughout the year?

No? Then this two-part series of articles is for you!

In Part 1, we take a look at the Carbon Tax Act that was implemented on the 1st of June 2019. We start with a basic introduction to greenhouse gases and what causes them. We then move on to how the Carbon Tax works, and how the revenue service measures the amount of emissions produced by your plant.

In Part 2, we will give an overview of how the carbon tax is calculated and then shed some light on how you can reduce the carbon footprint of your plant.

South Africa is the 14th largest greenhouse gas emitter in the world.

Given the global attention paid to Climate Change of late, it has become increasingly vital for our country to reduce emissions. Therefore, carbon tax was implemented with the intention to encourage cleaner practices.

What Causes Greenhouse Gases?

Fuel combustion is one of the most common activities that result in the emission of greenhouse gases. For example, companies that use boilers in their plant fall under the fuel combustion category. These companies will have to comply with the Carbon Tax act.

Greenhouse gases are also emitted from other processes apart from fuel combustion. Moreover, certain activities also inadvertently release greenhouse gases as fugitive emissions.

The Carbon Tax Act lists a range of industrial activities that release greenhouse gases. These activities are then further classified as causing either combustion process or fugitive emissions. The carbon tax obligation of the taxpayer is equivalent to the sum of the taxpayer’s combustion process and the fugitive emissions released.

Which Pollutants are referred to as Greenhouse Gases?

The carbon tax act lists six greenhouse gasses that are emitted from industrial activities. These pollutants are

- Carbon Dioxide (CO2),

- Methane (CH4),

- Nitrous Oxide (N2O),

- Hydrofluorocarbons (HFCs),

- Perfluorocarbons (PFCs) and

- Sulphur Hexafluoride (SF6)

How does Carbon Tax Work?

The treasury has implemented a 10 MW installed thermal input capacity threshold for combustion activities that result in emissions. This indicates that, regardless of utilisation or the fuel type, if your plant has the capacity to combust a minimum of 10MW (thermal), then your emissions will be subjected to carbon tax. It is required that the input capacity consist of the sum of all input capacities across all your facilities.

A lot of processes and fugitive emissions have no threshold which will result in you being taxed regardless how small your operation is. Activities such as domestic aviation and CO2 transport have unique thresholds, whilst certain activities such as stationary air conditioning, are not subjected to tax at all.

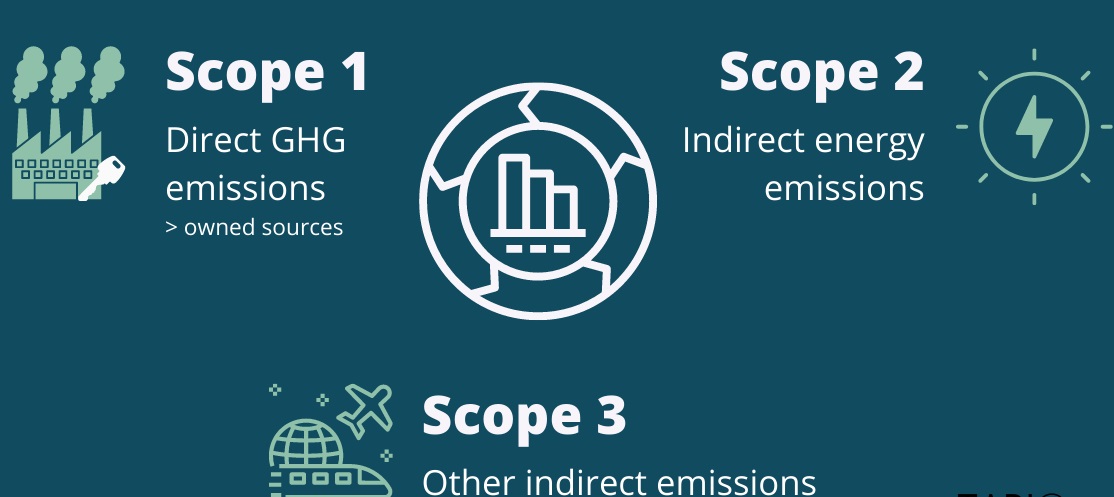

What are the Scopes of Emissions?

Scope 1

All Direct Emissions from the activities of an organisation or under their control. Including fuel combustion on site such as gas boilers, fleet vehicles and air-conditioning leaks.

Only Scope 1 emissions are taxable.

Scope 2

Indirect Emissions from electricity purchased and used by the organisation. Emissions are created during the production of the energy and eventually used by the organisation.

Scope 3

All Other Indirect Emissions from activities of the organisation, occurring from sources that they do not own or control. These are usually the greatest share of the carbon footprint, covering emissions associated with business travel, procurement, waste and water.

Scope 2 and 3 emissions are indirect, and thus the consequence is tariff increases.

How are emissions measured?

The activities in your plant will be subjected to a carbon tax if the combined capacity of your plant is over the threshold limit. The amount of tax that is paid depends on the actual emissions of the plant, but it is difficult and expensive to accurately measure.

Emitters in the country will have the option of using ‘emission factors’ that have been established by the Intergovernmental Panel on Climate Change. These factors are used to give an estimation of greenhouse gases that are emitted, depending on the amount of fuel burned or the amount of product produced.

The emission factors for greenhouse gases are depicted in the table below:

|

Greenhouse Gas |

Global Warming Potential |

|

Carbon Dioxide (CO2) |

1 |

|

Methane (CH4) |

23 |

|

Nitrous Oxide (N2O) |

296 |

|

Hexafluoroethane (C2F6) |

11 900 |

|

Carbon Tetrafluoride (CF4) |

5700 |

|

Sulphur Hexafluoride (SF6) |

22 200 |

As time progresses, more accurate domestic emission factors will be developed for use in South Africa.

Considering renewable energy?

We offer specialised solar solutions. CHAT to us for:

- Grid-tied, hybrid and off-grid solar system design and installation

- Bespoke solutions specific to your application and energy goals

- Guaranteed system performance