If you’re looking into investing in a solar system, first consider this important question… How will you fund the installation?

In this article, we’re discussing the different financial models to fund solar systems.

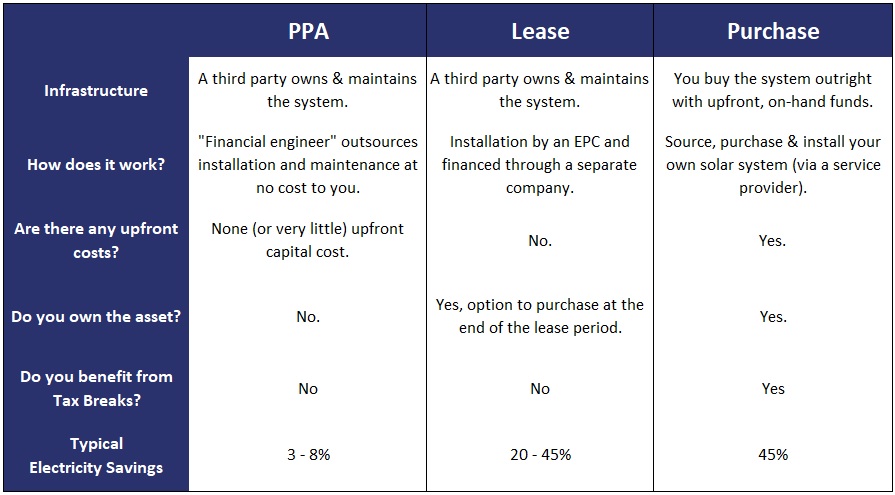

There are 3 solar funding models in the market:

1. Power Purchase Agreement (PPA)

2. Lease

3. Outright purchase

Obviously models do vary, but the fundamentals are generally the same. Familiarise yourself with the pro’s and con’s we’re highlighting in each option, and decide which is the most suitable way forward for your solar investment…

Power Purchase Agreement (PPA)

Ina PPA, the provider is generally a “Financial Engineer” whom outsources a separate contractor to install and maintain the solar system, at no cost to you. Typically, you will sign a contract of between 12 and 20 years, to take all power produced by the system.

Pay particular attention to the fine print. Be sure to establish if power produced and not consumed over the weekends, public holidays and shut-down periods will be billed or discounted. Generally, these contracts are factored on a “take or pay”, where you pay for all power produced, irrelevant of your requirement for it.

Moreover, be sure that you are as energy efficient as possible, before installing the solar system. For instance, if you change to LED lighting after a system is sized and installed, your electrical load profile will drop and you will be obligated to buy extra power that you are no longer using.

Furthermore, always ensure that you are going to be at the premises for at least the length of the contract. Otherwise, you will need to buy your way out of the contract when you move.

Lastly, you can expect a reduction in power cost of 10 -25% of the roughly 30-40% power the PPA provider will be supplying you. The net effect is that you will most likely see a discount of between 3 and 8% off you electricity costs.

Lease

With a lease, the asset is installed by an EPC (Engineering, Procurement and Construction) provider and financed through a separate company.

Did you know that Magnet has its own financing platform? Magnet Capital will provide the finance, whilst Magnet will also install the system. There is no deposit required, no surety required, funding is off the balance sheet, and it can be approved in a matter of weeks. As opposed to the banks, which often take months.

Furthermore, you can either have a zero escalation linked to prime, or have an 8% escalation matching the anticipated increase in energy cost. Cost of power dependent, some sites are cash positive from day one, with zero cash outlay.

After a 4, 5 or 6 year lease, the asset changes hands and all electricity savings are then enjoyed by the end user or land lord.

Site operational hours dependent, once the system has been paid off, electricity bill savings can vary between 20 and 45%.

If you have no Capex to allocate, then this is the most beneficial solution to use. Moreover, you won’t be locked into a 15 – 20 year PPA agreement with the risk of having to pay for all power produced and only seeing a 3-8% saving.

Learn more! Click here to download the Magnet Capital brochure now!

Outright purchase

If you have the capital, or can extend your bond to secure a loan below prime, then this could be the solution with the best financial returns…

When purchasing your own solar system, you simply award a service provider, take out a maintenance plan with them, and then you have a system that reduces your power consumption by up to 45%.

In addition, as the system is in the company’s name, that company is entitled to the SARS 12B depreciation benefit. Essentially this means 28% of the project value is tax deductible in year one. If the system is under a PPA or lease, you don’t get that tax break. However, under a lease, your repayments are tax deductible.

Learn more! Click below to read our articles on:

- Solar Tax Breaks

- Differentiating between the different solar systems

- 7 Common Solar Mistakes

In closing…

Solar power is definitely a sound investment. When considering which of the financing models is the best fit for you, remember to ask yourself these questions:

1. Who will own the asset?

2. Will you pay for power you don’t consume?

3. Will your Capex budget be positively or negatively affected?

4. How much energy savings will you see?

5. Is it important for you to benefit from Solar Tax Breaks?

Considering a solar or back-up power solution for your facility? Click here to chat to one of our experts now!